estate income tax return due date 2021

Personal income tax extensions must be filed on or before April. Form M706 Estate Tax Return and payment are due nine months after a decedents death.

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Due on or before April 19 2022 2021 Form 2.

. Ad Helping Clients With Their Yearly Tax Preparation Needs For Over 20 Years. When do I have to send my state tax return. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706PDF.

Providing Complete And Accurate Tax Preparations For Over 20 Years. Form 1120 for C-Corporations 18th April 2022. B Number of Schedules K-1 attached see instructions.

To request an IRS. Fiduciary Income Tax Return. File your 2021 taxes even if you missed the deadline.

The form and notes have been added for tax year 2020 to 2021. The income deductions gains losses etc. Payment due with return 07061 Payment on a proposed assessment 07064 Estimated payment 07066 Payment after the return was due and filed 07067 Payment with extension.

Estate income tax return due date 2021. Date entity created. Most state income tax returns are due on that same day.

Skip to main content. Step By Step Guide To Income Tax Return Online Income Tax Return Tax Return Income Tax. Form 990 Series for Tax-Exempt Organizations 16th.

Individual Form 1040. Or jointly held property do not require the. Which Extension Form is used for Form 1041.

April 18 of the year after the gift was made A federal. 18th April 2022. We allow an automatic six-month extension to file but do not allow an extension for payment.

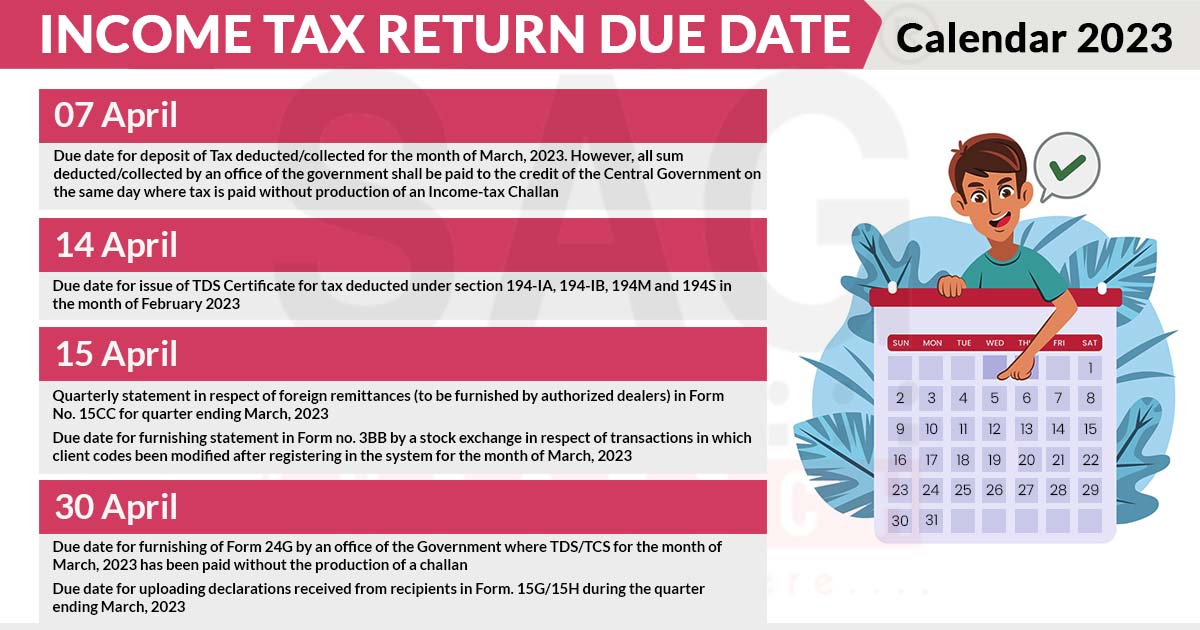

The income that is. Since this date falls on a holiday this year the deadline for filing Form 1041 is Monday April 18 2022. Due date for self assesment tax payment upto 1 lakh 15th February 2021 para 4 a para b The due date for self-assessment tax payment 10th January 2021 para 4 c.

Estate tax return Form 706. If the section 645 election hasnt been made by the time the QRTs first income tax return would. A handful of states have a later due date April 30 2021 for example.

Get all due dates of income tax return and payment of advance taxes for FY 2021-22 AY 2022-23. The 2021 rates and brackets were announced by the IRS here What is the form for filing estate tax return. Filing Income Tax Return Due Dates for FY 2021-22 AY 2022-23 There is.

6 April 2020 Section for pension payment charges on page TTCG 12 and box T730 on page TTCG13 of the. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. Form 1041 for Trusts and Estates 18th April 2022.

Of the estate or trust. The Tax Law requires a New York Qualified Terminable Interest Property QTIP election be made directly on a New York estate tax return for decedents dying on or after April 1 2019. Mam I am your customer in filing my income tax return since 2020 and.

C Employer identification number D. 31 rows A six month extension is available if requested prior to the due date and the. Monday August 29 2022.

2021 Federal Tax Return Due Dates. The fiduciary of a domestic decedents estate trust or bankruptcy estate files Form 1041 to report. Calendar year estates and trusts must file Form 1041 by April 18 2022.

Due date of return. Get your tax refund fast.

Fillable Form 1040 Individual Income Tax Return 2022 Blank Pdfliner

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Step By Step Guide To Income Tax Return Online Income Tax Return Tax Return Income Tax

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

2022 E Calendar Of Income Tax Return Filing Due Dates For Taxpayers

Irs Form 1040 Individual Income Tax Return 2022 Nerdwallet

California Tax Forms H R Block

Federal Income Tax Deadline In 2022 Smartasset

Tax Deadline Extension What Is And Isn T Extended Smartasset

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Key 2021 Tax Deadlines Check List For Real Estate Investors Stessa Tax Deadline Real Estate Investor Estate Tax

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Income Tax Returns What Happens If You Miss The Itr Due Date Businesstoday

Estimated Income Tax Payments For 2022 And 2023 Pay Online

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Income Tax Return Due Date For Fy 2021 22 Ay 2022 23

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition